Tax estimator 2020

See where that hard-earned money goes - with Federal Income Tax Social Security and other. 2020 Simple Federal Tax Calculator.

2020 2021 Tax Estimate Spreadsheet Higher Order Thinking Skills Interactive Lesson Plans Student Orientation

Use your estimate to change your tax withholding amount on Form W-4.

. Register and Subscribe Now to work on your IRS Form 1042 more fillable forms. Use the PriorTax 2020 tax calculator to find out your IRS tax refund or tax due amount. Gather your required documents.

Please note this calculator is for the 2022 tax year which is due. Ad You Can Do It. Coronavirus Aid Relief and Economic Security CARES Act permits self-employed individuals making estimated tax payments to defer the payment of 50 of the social security tax on net.

If you make 70000 a year living in the region of California USA you will be taxed 15111. All Available Prior Years Supported. Your average tax rate is 1198 and your marginal.

Ad File prior year 2020 taxes free. Property Tax Estimator Notice. Tax calculated using Qualified dividend and Capital gain tax worksheet is.

Ad Become an AARP Foundation Tax-Aide volunteer. Since 1968 weve helped nearly 68 million taxpayers with low income. Free Tax Preparation and eFile with Abc Management.

And is based on the tax. TurboTax Has Simple Step-By-Step Instructions To Help Along The Way. Find Everything You Need To Quickly Finish Your Past Years Taxes.

Ad Become an AARP Foundation Tax-Aide volunteer. File 2020 Taxes With Our Maximum Refund Guarantee. If the return is not complete by 531 a 99 fee for federal and 45 per state return will be applied.

Make a difference in your community today. Pays for itself TurboTax Self-Employed. Use your income filing status deductions credits to accurately estimate the taxes.

Effective tax rate 172. Our tax return calculator will estimate your refund and account for which credits are refundable and which are nonrefundable. Offer valid for returns filed 512020 - 5312020.

Calculated Tax based on your information using 2020 Tax Brackets is Your maximum tax bracket is. Based on your projected tax withholding for the year we can also estimate your tax refund or amount you may owe the IRS. HR Block does not provide audit attest or.

HR Block does not provide audit attest or. After You Use the Estimator. Income Tax Calculator The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return.

Have the full list of required tax documents ready. Make a difference in your community today. Or keep the same amount.

Estimate how much youll owe in federal taxes using your income deductions and credits all in just a few steps with our tax calculator. Our income tax calculator calculates your federal state and local taxes based on several key inputs. Estimates based on deductible business expenses calculated at the self-employment tax income rate 153 for tax year 2020.

Include your income deductions and credits to calculate. Figure out the amount of taxes you owe or your refund using our 2020 Tax Calculator. If the return is not complete by 531 a 99 fee for federal and 45 per state return will be applied.

Since 1968 weve helped nearly 68 million taxpayers with low income. Because tax rules change from year to year your tax refund. Free preparation for 2020 taxes.

To change your tax withholding amount. The Michigan Treasury Property Tax Estimator page will experience possible. Enter your filing status income deductions and credits and we will estimate your total taxes for tax year 2020.

How does the tax return estimator work. The 2022 Tax Calculator uses the 2022 Federal Tax Tables and 2022 Federal Tax Tables you can view the latest tax tables and historical tax tables used in our tax and salary calculators here. Estimate your 2021 tax refund today.

Offer valid for returns filed 512020 - 5312020. California Income Tax Calculator 2021. It is mainly intended for residents of the US.

Complete Edit or Print Tax Forms Instantly. The Tax Calculator uses tax information from the tax year 2022 to show you take-home pay. Your household income location filing status and number of personal.

Ad Access Tax Forms. 2020 MBT Forms 2021 Michigan Business Tax Forms Corporate Income Tax. Free Tax Preparation and eFile with Abc Management.

Including a W-2 and. Based on your projected tax withholding for.

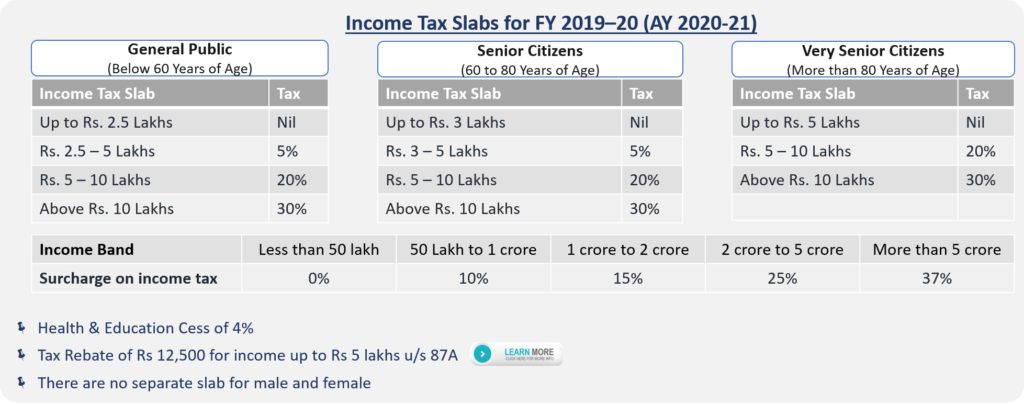

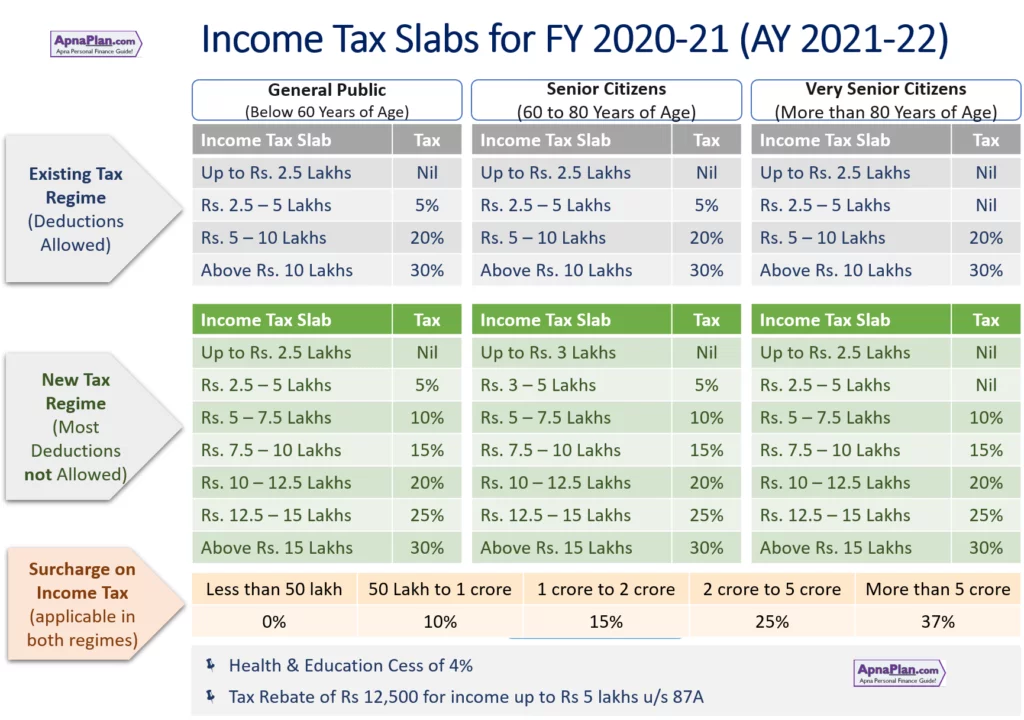

Income Tax Calculator India In Excel Fy 2021 22 Ay 2022 23 Apnaplan Com Personal Finance Investment Ideas

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Income Tax Calculator India In Excel Fy 2021 22 Ay 2022 23 Apnaplan Com Personal Finance Investment Ideas

Effective Tax Rate Formula Calculator Excel Template

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

How To Calculate Income Tax In Excel

What Are Marriage Penalties And Bonuses Tax Policy Center

Tax Calculator Estimate Your Income Tax For 2022 Free

Tax Schedule

:max_bytes(150000):strip_icc()/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

Australian Tax Calculator Excel Spreadsheet 2022 Atotaxrates Info

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

How To Calculate Income Tax In Excel

Effective Tax Rate Formula Calculator Excel Template

How To Calculate Payroll Taxes For Your Small Business

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

Tax Withholding For Pensions And Social Security Sensible Money